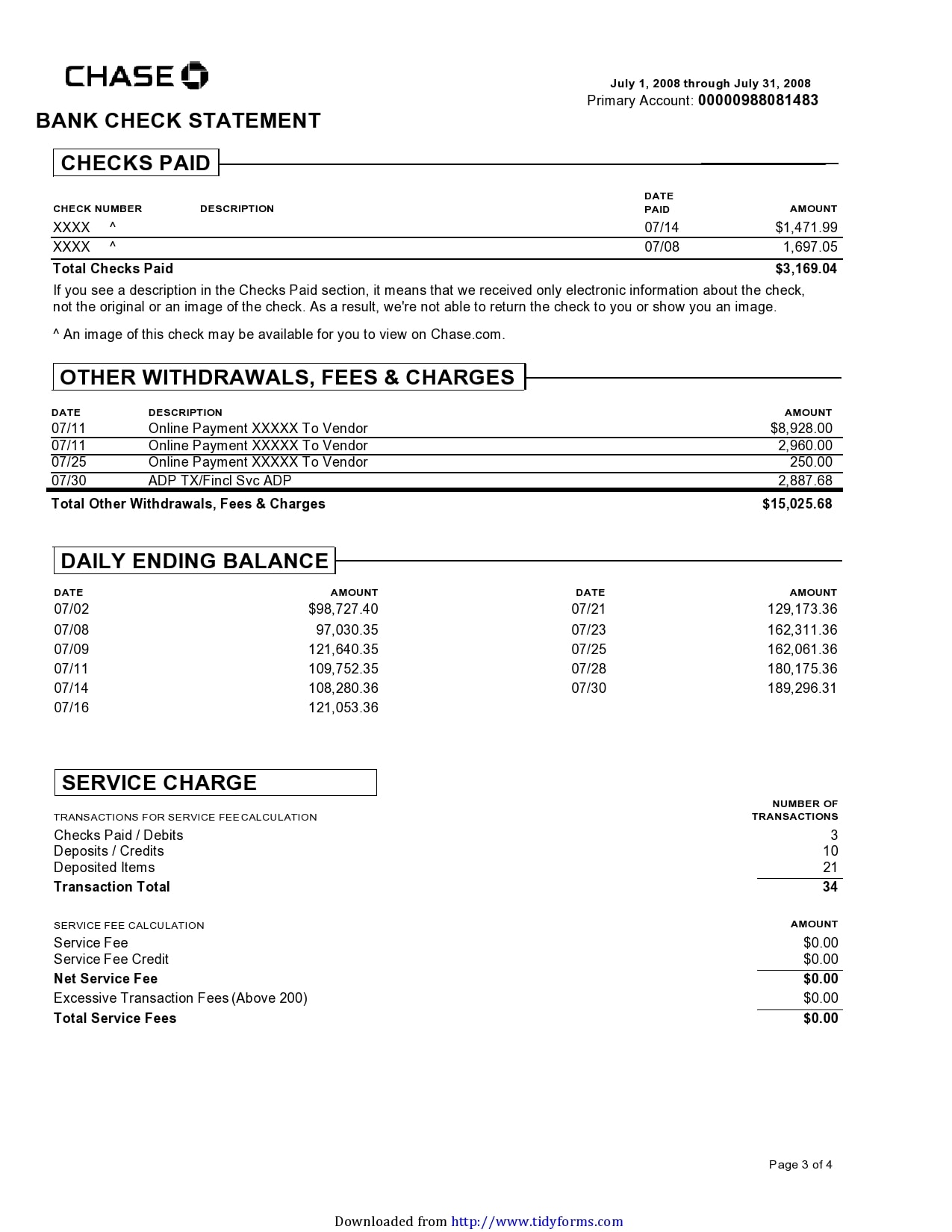

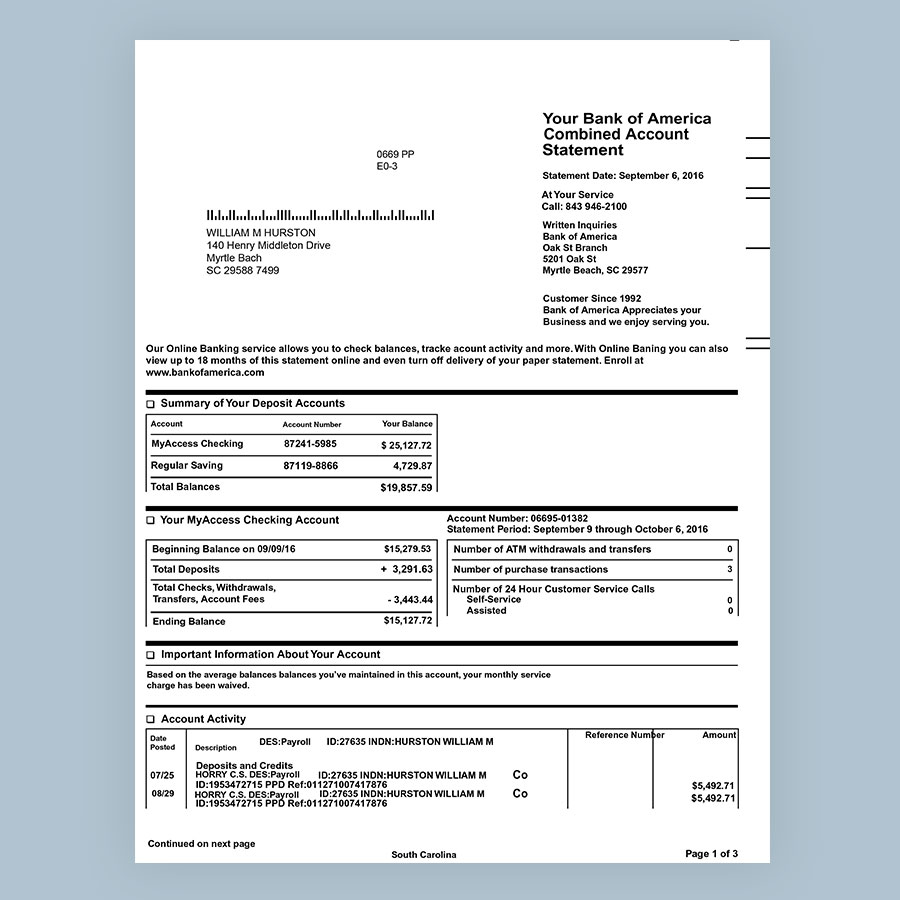

Sample bank statements enumerate the transactions from the date of your last transaction in your most recent statement to the completion of a specific period of time. "It takes a while for founders to adjust their own expectations of value, but that has been starting to properly come through in 2023," he said.Download even more EDITABLE & FREE Bank Statement Templates from What is a bank statement template?Ī bank statement helps account holders monitor their bank transactions and it’s sent by a bank to account holders regularly.

Mark Beeston, founder of Illuminate, said the tougher fundraising environment has led to more attractive valuations. Fintech companies raised $15 billion in the first three months of 2023, down about 50% from a year earlier.

Global financial institutions are projected to spend $57 billion maintaining outdated payments systems alone in 2028, up from $36.7 billion in 2022. Illuminate closed the round even as fundraising by fintech companies has slumped and some investors slashed the valuations for their holdings of privately held startups like Revolut Ltd. Illuminate strategic investors, including JPMorgan Chase, Barclays and Jeffries, also put money in the new fund. The fund will invest in startups that offer technology services to financial institutions. venture capital firm Illuminate Financial raised $235 million for its third fund from investors, including Bank of New York Mellon and Euroclear. This week, two former Wirecard employees were handed prison terms, the first criminal convictions related to the fraud at the firm. The firm's units that operated in Singapore had been asked to cease their payment activities in 2020. Wirecard filed for bankruptcy in 2020 after acknowledging that 1.9 billion euros ($2 billion) it had listed as assets probably didn't exist. The penalized firms have addressed the deficiencies identified by the Monetary Authority of Singapore (MAS), which include boosting their processes and training to improve staff's vigilance in detecting and escalating risk concerns. As it gains status as a key financial hub, Singapore has been moving to curb illicit flows in May, Parliament passed a bill paving the way for banks to share information on potentially risky clients. The penalties amount to S$400,000 on Citibank, S$600,000 on OCBC, S$200,000 on Swiss Life and S$2.6 million imposed on DBS. The four institutions were found to have inadequate money laundering and terrorism financing controls in place when they dealt with parties linked to Wirecard.

Singapore's financial regulator imposed penalties amounting to a total of S$3.8 million ($2.8 million) on DBS, Citigroup, Oversea-Chinese Banking and Swiss Life for breaches related to the Wirecard scandal.

0 kommentar(er)

0 kommentar(er)